Crypto is the payment of choice for child sexual abuse material

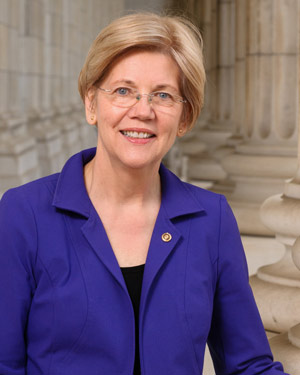

April 29, 2024 - Washington, D.C. – Last week, U.S. Senators Elizabeth Warren (D-Mass.) and Bill Cassidy (R-La.) sent a letter to Attorney General Merrick Garland and the Secretary of  Homeland Security, Alejandro Mayorkas, regarding the use of cryptocurrency in the illegal trade of child sexual abuse material (CSAM). As crypto becomes the payment of choice for buying and selling CSAM, the senators are pushing the Department of Justice and the Department of Homeland Security for the information needed to begin addressing this problem in Congress.

Homeland Security, Alejandro Mayorkas, regarding the use of cryptocurrency in the illegal trade of child sexual abuse material (CSAM). As crypto becomes the payment of choice for buying and selling CSAM, the senators are pushing the Department of Justice and the Department of Homeland Security for the information needed to begin addressing this problem in Congress.

“The pseudonymity provided by cryptocurrency has allowed the payments for CSAM to “move quickly into the crypto world,” and we are committed to ensuring that Congress and the Administration have the full suite of tools needed to end CSAM and punish sellers of this material,” wrote the senators.

A January 2024 report by Chainalysis, a blockchain analytics firm, found that “cryptocurrency-based sales of CSAM are a growing problem,” with one expert noting that “virtual currency is the dominant choice for buyers and sellers of commercial child sexual abuse content.” And in February, the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) published a Financial Trend Analysis of 2020-2021 data which found that “[p]erpetrators of online child sexual exploitation are increasingly using convertible virtual currency to try to avoid detection.”

FinCEN also found that financial institutions filed thousands of online child sexual exploitation- (OCSE) and human-trafficking- related suspicious activity reports involving bitcoin, and “identified over 1,800 unique bitcoin wallet addresses related to suspected OCSE and human trafficking offenses.” Ninety-five percent of these reports cited CSAM specifically.

“These are deeply troubling findings revealing the extent to which cryptocurrency is the payment of choice for perpetrators of child sexual abuse and exploitation,” wrote the senators. “Now, the use of cryptocurrency in the illicit trade of CSAM appears to be increasing.”

The Internet Watch Foundation (IWF) found that “the number of websites accepting cryptocurrency as payment in exchange for [CSAM] has more than doubled every year” between 2018 and 2022. IWF reported that 1,014 sites containing child sexual abuse gave criminals the option of crypto payments in 2021, compared to 468 sites in 2020.

“Existing anti-money laundering rules and law enforcement methods face challenges in effectively detecting and preventing these crimes – and we seek to ensure that Congress and the Administration are doing their part to address these challenges,” the senators concluded.

Senator Warren is an outspoken advocate for regulation and oversight of crypto to rein in unchecked illegal activity and protect consumers, the financial system, and national security:

-

In April 2024, at a hearing of the Senate Committee on Banking, Housing, and Urban Affairs, Senator Warren asked Deputy Secretary Adeyemo about gaps in AML rules that allow sanctioned entities like Iran to earn revenue processing crypto transactions, highlighting that validators, middlemen between the payer and receiver in crypto transactions, are not subject to the same AML rules as the traditional banking industry.

-

In April 2024, Senator Warren wrote to the House Financial Services Committee Chair Patrick McHenry (R-N.C.) and Ranking Member Maxine Waters (D-Calif.) urging them to include strong rules that protect consumers, financial stability, and our national security in any upcoming legislation related to stablecoins.

-

In December 2023, Senator Warren sent letters to three crypto giants: the Blockchain Association, Coin Center, and Coinbase, asking each about their use of the revolving door to undermine efforts to rein in crypto’s use in terrorist financing.

-

In December 2023, Senator Warren announced an expanded coalition of Senate support for the bipartisan Digital Asset Anti-Money Laundering Act. Senators Raphael Warnock (D-Ga.), Laphonza Butler (D-Calif.), Chris Van Hollen (D-Md.), all members of the Senate Banking, Housing, and Urban Affairs Committee, and Senators John Hickenlooper (D-Colo.) and Ben Ray Luján (D-N.M.) joined the bill as cosponsors.

-

In December 2023, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren questioned Big Bank CEOs, who agreed on the need to apply anti-money laundering rules to crypto companies to protect national security.

-

In October 2023, Senators Warren and Marshall and Representative Sean Casten (D-Ill.) led 102 lawmakers in a bipartisan letter to National Security Advisor Jake Sullivan and Brian Nelson, Under Secretary for Terrorism and Financial Intelligence at the Department of the Treasury raising grave concerns about reports that in the months leading up to their brutal October 7th terrorist attack on Israel, Hamas and Palestinian Islamic Jihad raised millions of dollars via crypto, evading U.S. sanctions to fund their operations.

-

In October 2023, at a hearing of the Senate Armed Services Committee, Senator Warren spoke about the need to crack down threats posed by crypto, noting that half of North Korea’s missile program is paid for through crypto crime.

-

In September 2023, Senators Warren, Roger Marshall (R-Kan.), Joe Manchin (D-W.Va.), and Lindsey Graham (R-S.C.) announced an expanded coalition of Senate support for their bipartisan Digital Asset Anti-Money Laundering Act, announcing 11 new cosponsors of their legislation – Senators Peters, Dick Durbin (D-Ill.), Chair of the Senate Judiciary Committee, Smith, King, Shaheen, Bob Casey (D-Pa.), Blumenthal, Bennet, Cortez Masto, Fetterman, and Whitehouse.

-

In July 2023, Senator Warren, along with Senators Marshall, Manchin, and Graham reintroduced the Digital Asset Anti-Money Laundering Act, legislation that would mitigate the risks that digital assets pose to our national security by closing loopholes and bringing the digital asset ecosystem into greater compliance with the anti-money laundering and countering the financing of terrorism (AML/CFT) frameworks governing the greater financial system.

-

In July 2023, at a hearing, Senator Warren warned about the national security risks of rogue states using crypto to evade sanctions and fund their weapons programs, spying, and cyberattacks – calling out North Korea for stealing over $3 billion in crypto over the past 5 years, and using proceeds to fund its illegal nuclear weapons program,

-

In May 2023, a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren called out crypto’s role in fueling the fentanyl crisis and announced she will reintroduce her bipartisan Digital Asset Anti-Money Laundering Act, a bill that would close loopholes in anti-money laundering rules, cutting off drug suppliers and cartels from using crypto to facilitate their illegal business.

-

In May 2023, at a hearing of the Senate Armed Services Committee, Senator Warren questioned senior intelligence officials about crypto’s threats to national security as the method of choice for countries to evade sanctions and fund weapons programs, support spying, and promote cyber attacks.

-

In February 2023, at a hearing of the Senate Committee on Banking, Housing, and Urban Affairs, Senator Warren raised concerns that key parts of the crypto industry are not subject to the same money laundering laws that cover other financial organizations, allowing financial criminals to use crypto to launder billions.

-

On December 14, 2022, Senators Warren and Marshall introduced the Digital Asset Anti-Money Laundering Act of 2022, bipartisan legislation that would mitigate the risks that crypto and other digital assets pose to US national security by closing loopholes in the existing anti-money laundering and countering of the financing of terrorism framework and bring the digital asset ecosystem into greater compliance with the rules that govern the rest of the financial system.

-

In September 2022, Senator Warren sent a letter to Treasury Secretary Janet Yellen calling on the Treasury Department and the Financial Stability Oversight Council to build a strong regulatory framework for the crypto market.

-

In March 2022, Senators Warren, Reed, Warner, and Tester introduced the Digital Asset Sanctions Compliance Enhancement Act to ensure that Vladimir Putin and Russian elites don't use digital assets to undermine the international community’s economic sanctions against Russia following its invasion of Ukraine.

-

In March 2022, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren highlighted the various crypto tools that could make it easier for sanctioned individuals to hide their wealth and lessen the impact of Russian sanctions.

-

In March 2022, at a hearing of the Senate Banking, Housing, and Urban Affairs Committee, Senator Warren warned that crypto may allow Russia to dodge sanctions and urged stronger regulation of the crypto market to ensure that countries, drug traffickers, cyber criminals, and tax cheats can’t evade economic pain.

-

In March 2022, Senators Warren, Warner, Reed, and Brown sent a letter to Treasury Secretary Janet Yellen, asking about the Treasury Department’s plans to enforce sanctions-compliance guidance for the crypto industry to ensure that economic sanctions remain an effective tool for achieving foreign policy goals.

Source: Senator Elizabeth Warren