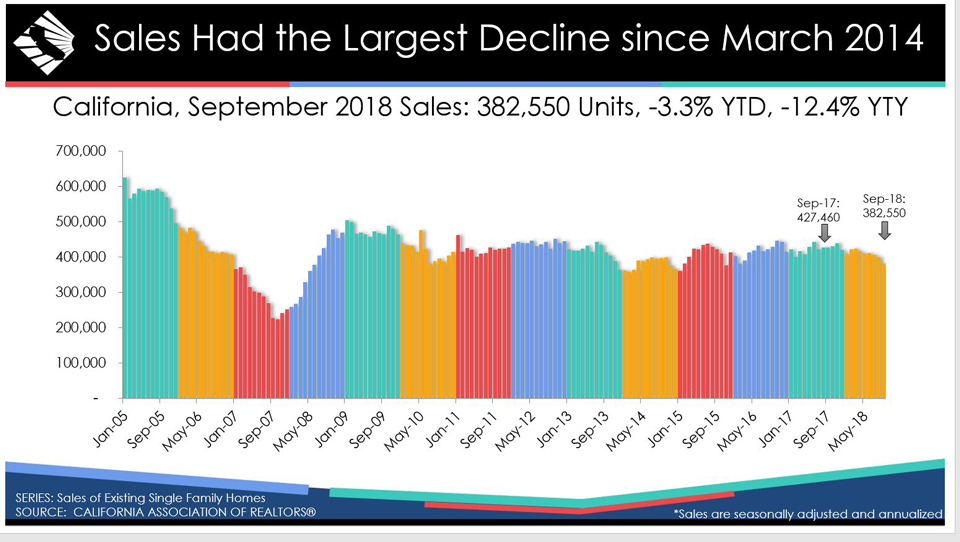

- Existing, single-family home sales totaled 382,550 in September on a seasonally adjusted annualized rate, down 4.3 percent from August and down 12.4 percent from September 2017.

- September’s statewide median home price was $578,850, down 2.9 percent from August but up 4.2 percent from September 2017.

- Statewide active listings rose for the sixth consecutive month, increasing 20.4 percent from the previous year.

- Inventory reached the highest level in 31 months, with the Unsold Inventory Index reaching 4.2 months in September.

- September year-to-date sales were down 3.3 percent.

October 24, 2018 - LOS ANGELES – The California housing market posted its largest year-over-year sales decline since March 2014 and remained below the 400,000-level sales benchmark for the second consecutive month in September, indicating that the market is slowing as many potential buyers put their homeownership plans on hold, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said om Monday.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 382,550 units in September, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

September’s sales figure was down 4.3 percent from the revised 399,600 level in August and down 12.4 percent compared with home sales in September 2017 of 436,920.

“The housing market continued to deteriorate and the decline in sales worsened as interest rates remained on an upward trend. More would-be buyers are self-sidelining as they believe home prices will start to come down soon, making housing more affordable despite rising interest rates,” said C.A.R. President Steve White. “Tax reform, which increases the cost of homeownership, also is contributing to the decline, especially in high-cost areas such as the San Francisco Bay Area and Orange County.”

The statewide median home price dropped to $578,850 in September. The September statewide median price was down 2.9 percent from $596,410 in August but up 4.2 percent from a revised $555,400 in September 2017.

“Price appreciations have slowed in the last few months and inventory has risen considerably since June when the statewide median price hit a new peak,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “Buyers are becoming increasingly concerned about market developments and are reluctant to purchase at the prevailing market price. As such, the deceleration in price growth will likely continue in coming months.”

Other key points from C.A.R.’s September 2018 resale housing report include:

- On a regionwide, non-seasonally adjusted basis, the Southern California region led the state’s sales decline, falling 17.3 percent from a year ago. Los Angeles County experienced the largest drop in the region at 22 percent, while Orange County declined 21.8 percent. Sales in the Inland Empire were down 10.8 percent from a year ago, with Riverside and San Bernardino counties recording an annual sales decline of 9.7 percent and 12.4 percent, respectively.

- Sales in the Bay Area declined 16.4 percent from September 2017, the largest decline since October 2010. Santa Clara posted the largest drop at 22.6 percent, while Marin experienced the lowest decline at 1.1 percent. Alameda (-10.4 percent), Contra Costa

(-17.3 percent), Napa (-14.2 percent), San Francisco (-11.5 percent), San Mateo (-14.6 percent), Solano (-19.3 percent), and Sonoma (-19.4 percent) counties all posted double-digit declines. - Although Glenn and Kings counties posted annual sales gains of 9.1 percent and 11.1 percent, respectively, sales for the Central Valley Region as a whole were down 15.1 percent from a year ago. Every other county of the region posted declines from a year ago.

- While home prices continue to grow in the Bay Area, the rate of appreciation has slowed since the first half of the year. In September, the median price in the Bay Area increased 9.8 percent from last year, lower than the average year-over-year growth rate of 14.9 percent. Three counties continued to show double-digit growth compared with the previous year: San Mateo (14.2 percent), San Francisco (11.7 percent) and Marin (11.6 percent).

- Sales in Los Angeles and Orange counties both dropped 20 percent in September, which is taking a toll on the price appreciation of each county and the Southern California region as a whole. The Los Angeles Metropolitan Area had the lowest year-over-year growth rate of 3.4 percent in September among all major regions. Individually, Los Angeles County and Orange County had the smallest growth rates of 4.7 percent and 3.3 percent, respectively, among all counties within the region. Riverside and San Diego also had modest growth rates of around 5 percent in September, while Ventura and San Bernardino had more robust price appreciation at 10.6 percent and 7.5 percent, respectively.

- Statewide active listings rose for the sixth consecutive month following 33 straight months of declines, increasing 20.4 percent from the previous year. September’s listings increase was the biggest in nearly four years.

- At the regional level, the San Francisco Bay Area increased the most in active listings, with a surge of 44 percent year over year. The increase was most obvious in Santa Clara, as the county’s active listings more than doubled (+113 percent) from last September. The Southern California region and the Central Valley region also had substantial gains in active listings, with year-over-year increases of 23 percent and 13 percent, respectively.

- The Unsold Inventory Index, which is a ratio of inventory over sales, rose again in September from 3.3 months in September 2017 to 4.2 months in September 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

- The median number of days it took to sell a California single-family home ticked up from 20 days in September 2017 to 23 days in September 2018, a sign that market competitiveness is not as heated as in 2017.

- C.A.R.’s statewide sales price-to-list price ratio* hit the lowest level in 20 months but was down from a year ago at 98.5 percent in September 2018 compared with 99.1 percent in September 2017. The decline indicates that buyers may have more negotiation power in the current market than a year ago.

- The average statewide price per square foot** for an existing, single-family home statewide was $282 in September, up from $270 in September 2017, but dipped slightly from $283 in August 2018.

- The 30-year, fixed-mortgage interest rates averaged 4.63 percent in September, up from 3.81 percent in September 2017, according to Freddie Mac. The five-year, adjustable mortgage interest rate also increased in September to an average of 3.94 percent from 3.16 percent from September 2017.

Graphics (click links to open):

- Calif. historical existing home sales.

- Calif. historical median home price.

- Active listings increase six straight months.

- Inventory Index reaches highest level in 31 months.

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data are not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower-end or the upper-end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 50 counties.

Leading the way…® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 190,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

September 2018 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

|

September-18 |

Median Sold Price of Existing Single-Family Homes |

Sales |

||||||||||

|

State/Region/County |

Sep-18 |

Aug-18 |

Sep-17 |

Price MTM% Chg |

Price YTY% Chg |

Sep-18 |

Aug-18 |

Sep-17 |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

CA SFH (SAAR) |

$578,850 |

$596,410 |

$555,400 |

r |

-2.9% |

4.2% |

382,550 |

399,600 |

436,920 |

-4.3% |

-12.4% |

|

|

CA Condo/Townhomes |

$477,140 |

$474,570 |

$450,400 |

r |

0.5% |

5.9% |

4,445 |

5,764 |

5,377 |

-22.9% |

-17.3% |

|

|

Los Angeles Metropolitan Area |

$520,000 |

$525,000 |

$503,000 |

r |

-1.0% |

3.4% |

7,402 |

9,119 |

8,986 |

-18.8% |

-17.6% |

|

|

Central Coast |

$678,990 |

$675,280 |

$652,500 |

0.5% |

4.1% |

791 |

1,005 |

914 |

-21.3% |

-13.5% |

||

|

Central Valley |

$325,000 |

$325,000 |

$311,000 |

0.0% |

4.5% |

4,372 |

5,534 |

5,152 |

-21.0% |

-15.1% |

||

|

Inland Empire |

$356,000 |

$365,000 |

$337,000 |

r |

-2.5% |

5.6% |

2,952 |

3,591 |

3,310 |

-17.8% |

-10.8% |

|

|

S.F. Bay Area |

$930,000 |

$935,000 |

$846,875 |

r |

-0.5% |

9.8% |

3,582 |

4,665 |

4,283 |

-23.2% |

-16.4% |

|

|

S.F. Bay Area |

Sep-18 |

Aug-18 |

Sep-17 |

Price MTM% Chg |

Price YTY% Chg |

Sep-18 |

Aug-18 |

Sep-17 |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

Alameda |

$900,000 |

$960,000 |

$853,000 |

-6.3% |

5.5% |

718 |

940 |

801 |

-23.6% |

-10.4% |

||

|

Contra Costa |

$650,000 |

$650,000 |

$605,000 |

0.0% |

7.4% |

765 |

1,018 |

925 |

-24.9% |

-17.3% |

||

|

Marin |

$1,395,000 |

$1,222,500 |

$1,250,000 |

14.1% |

11.6% |

175 |

210 |

177 |

-16.7% |

-1.1% |

||

|

Napa |

$685,000 |

$752,500 |

$632,500 |

-9.0% |

8.3% |

91 |

124 |

106 |

-26.6% |

-14.2% |

||

|

San Francisco |

$1,507,500 |

$1,550,000 |

$1,350,000 |

-2.7% |

11.7% |

146 |

183 |

165 |

-20.2% |

-11.5% |

||

|

San Mateo |

$1,600,000 |

$1,500,000 |

$1,400,500 |

6.7% |

14.2% |

309 |

374 |

362 |

-17.4% |

-14.6% |

||

|

Santa Clara |

$1,250,000 |

$1,295,000 |

$1,180,000 |

-3.5% |

5.9% |

731 |

940 |

945 |

-22.2% |

-22.6% |

||

|

Solano |

$451,500 |

$455,000 |

$422,500 |

-0.8% |

6.9% |

322 |

431 |

399 |

-25.3% |

-19.3% |

||

|

Sonoma |

$654,500 |

$670,000 |

$620,000 |

-2.3% |

5.6% |

325 |

445 |

403 |

-27.0% |

-19.4% |

||

|

Southern California |

Sep-18 |

Aug-18 |

Sep-17 |

Price MTM% Chg |

Price YTY% Chg |

Sep-18 |

Aug-18 |

Sep-17 |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

Los Angeles |

$634,680 |

$607,490 |

$606,110 |

4.5% |

4.7% |

2,797 |

3,422 |

3,584 |

-18.3% |

-22.0% |

||

|

Orange |

$825,000 |

$838,500 |

$799,000 |

-1.6% |

3.3% |

1,272 |

1,595 |

1,627 |

-20.3% |

-21.8% |

||

|

Riverside |

$405,950 |

$400,750 |

$385,700 |

1.3% |

5.3% |

1,750 |

2,098 |

1,938 |

-16.6% |

-9.7% |

||

|

San Bernardino |

$300,000 |

$290,000 |

$279,000 |

3.4% |

7.5% |

1,202 |

1,493 |

1,372 |

-19.5% |

-12.4% |

||

|

San Diego |

$640,000 |

$660,000 |

$605,000 |

-3.0% |

5.8% |

1,625 |

2,071 |

1,925 |

-21.5% |

-15.6% |

||

|

Ventura |

$673,750 |

$660,000 |

$609,000 |

2.1% |

10.6% |

381 |

511 |

465 |

-25.4% |

-18.1% |

||

|

Central Coast |

Sep-18 |

Aug-18 |

Sep-17 |

Price MTM% Chg |

Price YTY% Chg |

Sep-18 |

Aug-18 |

Sep-17 |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

Monterey |

$624,004 |

$599,000 |

$569,900 |

4.2% |

9.5% |

230 |

235 |

217 |

-2.1% |

6.0% |

||

|

San Luis Obispo |

$639,000 |

$630,000 |

$607,500 |

1.4% |

5.2% |

237 |

306 |

278 |

-22.5% |

-14.7% |

||

|

Santa Barbara |

$677,500 |

$572,500 |

$707,000 |

18.3% |

-4.2% |

190 |

276 |

241 |

-31.2% |

-21.2% |

||

|

Santa Cruz |

$910,500 |

$917,500 |

$845,000 |

-0.8% |

7.8% |

134 |

188 |

178 |

-28.7% |

-24.7% |

||

|

Central Valley |

Sep-18 |

Aug-18 |

Sep-17 |

Price MTM% Chg |

Price YTY% Chg |

Sep-18 |

Aug-18 |

Sep-17 |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

Fresno |

$267,000 |

$280,000 |

$265,000 |

-4.6% |

0.8% |

621 |

799 |

726 |

-22.3% |

-14.5% |

||

|

Glenn |

$227,500 |

$225,500 |

$207,500 |

0.9% |

9.6% |

24 |

12 |

22 |

100.0% |

9.1% |

||

|

Kern |

$241,000 |

$247,000 |

$234,700 |

-2.4% |

2.7% |

450 |

591 |

490 |

-23.9% |

-8.2% |

||

|

Kings |

$239,950 |

$227,750 |

$223,000 |

5.4% |

7.6% |

90 |

112 |

81 |

-19.6% |

11.1% |

||

|

Madera |

$282,500 |

$254,900 |

$269,900 |

10.8% |

4.7% |

132 |

143 |

166 |

-7.7% |

-20.5% |

||

|

Merced |

$280,000 |

$288,396 |

$260,000 |

-2.9% |

7.7% |

111 |

178 |

139 |

-37.6% |

-20.1% |

||

|

Placer |

$475,000 |

$475,000 |

$450,000 |

0.0% |

5.6% |

429 |

562 |

528 |

-23.7% |

-18.8% |

||

|

Sacramento |

$372,000 |

$369,950 |

$347,750 |

0.6% |

7.0% |

1,290 |

1,632 |

1,496 |

-21.0% |

-13.8% |

||

|

San Benito |

$562,000 |

$575,000 |

$508,500 |

-2.3% |

10.5% |

38 |

40 |

40 |

-5.0% |

-5.0% |

||

|

San Joaquin |

$360,000 |

$380,000 |

$355,000 |

-5.3% |

1.4% |

495 |

620 |

651 |

-20.2% |

-24.0% |

||

|

Stanislaus |

$315,000 |

$319,900 |

$295,000 |

-1.5% |

6.8% |

442 |

532 |

509 |

-16.9% |

-13.2% |

||

|

Tulare |

$240,000 |

$239,000 |

$229,950 |

0.4% |

4.4% |

250 |

313 |

304 |

-20.1% |

-17.8% |

||

|

Other Counties in California |

Sep-18 |

Aug-18 |

Sep-17 |

Price MTM% Chg |

Price YTY% Chg |

Sep-18 |

Aug-18 |

Sep-17 |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

Amador |

NA |

NA |

$315,000 |

NA |

NA |

NA |

NA |

54 |

NA |

NA |

||

|

Butte |

$320,000 |

$315,000 |

$311,900 |

1.6% |

2.6% |

137 |

202 |

151 |

-32.2% |

-9.3% |

||

|

Calaveras |

$328,000 |

$340,000 |

$340,000 |

-3.5% |

-3.5% |

101 |

125 |

97 |

-19.2% |

4.1% |

||

|

Del Norte |

$205,000 |

$249,900 |

$224,300 |

-18.0% |

-8.6% |

25 |

21 |

18 |

19.0% |

38.9% |

||

|

El Dorado |

$465,000 |

$480,000 |

$449,950 |

-3.1% |

3.3% |

265 |

334 |

326 |

-20.7% |

-18.7% |

||

|

Humboldt |

$315,000 |

$315,000 |

$325,000 |

0.0% |

-3.1% |

102 |

125 |

119 |

-18.4% |

-14.3% |

||

|

Lake |

$288,000 |

$265,000 |

$234,250 |

8.7% |

22.9% |

61 |

89 |

86 |

-31.5% |

-29.1% |

||

|

Lassen |

$159,450 |

$192,500 |

$145,500 |

-17.2% |

9.6% |

26 |

33 |

28 |

-21.2% |

-7.1% |

||

|

Mariposa |

$299,000 |

$315,000 |

$299,000 |

-5.1% |

0.0% |

9 |

9 |

7 |

0.0% |

28.6% |

||

|

Mendocino |

$433,500 |

$430,000 |

$419,000 |

0.8% |

3.5% |

48 |

57 |

63 |

-15.8% |

-23.8% |

||

|

Mono |

$622,500 |

$880,000 |

$632,500 |

-29.3% |

-1.6% |

14 |

15 |

22 |

-6.7% |

-36.4% |

||

|

Nevada |

$445,000 |

$420,000 |

$410,000 |

6.0% |

8.5% |

91 |

139 |

107 |

-34.5% |

-15.0% |

||

|

Plumas |

$265,000 |

$292,250 |

$275,000 |

-9.3% |

-3.6% |

32 |

48 |

41 |

-33.3% |

-22.0% |

||

|

Shasta |

$255,000 |

$286,000 |

$244,900 |

-10.8% |

4.1% |

259 |

299 |

263 |

-13.4% |

-1.5% |

||

|

Siskiyou |

$205,000 |

$216,000 |

$187,500 |

-5.1% |

9.3% |

55 |

58 |

49 |

-5.2% |

12.2% |

||

|

Sutter |

$290,000 |

$310,000 |

$275,000 |

-6.5% |

5.5% |

61 |

79 |

84 |

-22.8% |

-27.4% |

||

|

Tehama |

$228,000 |

$208,500 |

$191,750 |

9.4% |

18.9% |

41 |

38 |

32 |

7.9% |

28.1% |

||

|

Tuolumne |

$291,400 |

$331,365 |

$282,000 |

-12.1% |

3.3% |

61 |

84 |

82 |

-27.4% |

-25.6% |

||

|

Yolo |

$470,000 |

$450,000 |

$432,000 |

4.4% |

8.8% |

102 |

151 |

152 |

-32.5% |

-32.9% |

||

|

Yuba |

$257,500 |

$269,000 |

$274,900 |

-4.3% |

-6.3% |

70 |

107 |

79 |

-34.6% |

-11.4% |

||

September 2018 County Unsold Inventory and Time on Market

(Regional and condo sales data not seasonally adjusted)

|

September-18 |

Unsold Inventory Index |

Median Time on Market |

||||||||

|

State/Region/County |

Sep-18 |

Aug-18 |

Sep-17 |

Sep-18 |

Aug-18 |

Sep-17 |

||||

|

CA SFH (SAAR) |

4.2 |

3.3 |

3.3 |

r |

23.0 |

21.0 |

20.0 |

|||

|

CA Condo/Townhomes |

3.6 |

2.7 |

2.4 |

20.0 |

18.0 |

15.0 |

||||

|

Los Angeles Metropolitan Area |

4.5 |

3.6 |

3.4 |

28.0 |

25.0 |

24.0 |

||||

|

Central Coast |

4.7 |

3.8 |

4.0 |

26.0 |

25.0 |

27.0 |

||||

|

Central Valley |

3.7 |

3.0 |

3.0 |

18.0 |

16.0 |

15.0 |

||||

|

Inland Empire |

4.5 |

3.8 |

3.7 |

34.0 |

31.0 |

27.0 |

||||

|

S.F. Bay Area |

3.2 |

2.3 |

2.2 |

19.0 |

18.0 |

16.0 |

||||

|

S.F. Bay Area |

Sep-18 |

Aug-18 |

Sep-17 |

Sep-18 |

Aug-18 |

Sep-17 |

||||

|

Alameda |

2.7 |

2.0 |

2.1 |

14.0 |

14.0 |

13.0 |

||||

|

Contra Costa |

2.9 |

2.2 |

2.2 |

16.0 |

15.0 |

14.0 |

||||

|

Marin |

3.5 |

2.7 |

3.4 |

30.0 |

34.0 |

38.0 |

||||

|

Napa |

5.6 |

4.3 |

4.6 |

39.0 |

35.5 |

49.5 |

||||

|

San Francisco |

3.4 |

2.2 |

2.6 |

14.0 |

17.0 |

15.0 |

||||

|

San Mateo |

2.9 |

2.1 |

1.9 |

13.0 |

12.0 |

11.0 |

||||

|

Santa Clara |

2.8 |

2.0 |

1.4 |

15.0 |

13.0 |

10.0 |

||||

|

Solano |

3.5 |

2.6 |

2.4 |

34.5 |

32.0 |

34.0 |

||||

|

Sonoma |

4.5 |

3.4 |

3.0 |

47.0 |

37.0 |

41.0 |

||||

|

Southern California |

Sep-18 |

Aug-18 |

Sep-17 |

Sep-18 |

Aug-18 |

Sep-17 |

||||

|

Los Angeles |

4.4 |

3.4 |

3.1 |

21.0 |

19.0 |

19.0 |

||||

|

Orange |

4.3 |

3.5 |

3.1 |

29.0 |

22.0 |

26.0 |

||||

|

Riverside |

4.6 |

3.8 |

3.7 |

34.0 |

31.5 |

26.0 |

||||

|

San Bernardino |

4.4 |

3.8 |

3.6 |

34.0 |

30.0 |

27.0 |

||||

|

San Diego |

4.1 |

3.4 |

3.0 |

19.0 |

18.0 |

16.0 |

||||

|

Ventura |

6.3 |

4.9 |

4.7 |

46.5 |

50.5 |

50.0 |

||||

|

Central Coast |

Sep-18 |

Aug-18 |

Sep-17 |

Sep-18 |

Aug-18 |

Sep-17 |

||||

|

Monterey |

4.1 |

4.1 |

4.7 |

20.0 |

23.0 |

27.0 |

||||

|

San Luis Obispo |

4.7 |

3.8 |

3.9 |

39.0 |

31.0 |

32.0 |

||||

|

Santa Barbara |

5.6 |

4.0 |

4.1 |

26.0 |

31.0 |

31.0 |

||||

|

Santa Cruz |

4.3 |

3.1 |

3.4 |

19.0 |

17.5 |

18.0 |

||||

|

Central Valley |

Sep-18 |

Aug-18 |

Sep-17 |

Sep-18 |

Aug-18 |

Sep-17 |

||||

|

Fresno |

3.9 |

3.1 |

3.1 |

17.0 |

13.0 |

12.0 |

||||

|

Glenn |

2.9 |

6.9 |

3.5 |

57.5 |

64.5 |

30.5 |

||||

|

Kern |

3.6 |

2.9 |

3.5 |

20.5 |

17.0 |

22.0 |

||||

|

Kings |

3.6 |

2.8 |

3.3 |

16.0 |

23.0 |

23.0 |

||||

|

Madera |

5.5 |

5.4 |

5.5 |

35.5 |

29.0 |

r |

22.0 |

|||

|

Merced |

4.3 |

2.7 |

2.8 |

14.0 |

17.0 |

14.0 |

||||

|

Placer |

3.6 |

2.8 |

2.8 |

22.0 |

17.0 |

17.0 |

||||

|

Sacramento |

3.2 |

2.7 |

2.6 |

15.0 |

14.0 |

13.0 |

||||

|

San Benito |

4.3 |

4.4 |

4.5 |

22.5 |

38.0 |

13.0 |

||||

|

San Joaquin |

3.8 |

3.1 |

2.6 |

17.0 |

17.0 |

16.0 |

||||

|

Stanislaus |

3.3 |

2.9 |

2.6 |

20.0 |

16.0 |

18.0 |

||||

|

Tulare |

4.6 |

3.8 |

3.7 |

29.0 |

28.0 |

20.0 |

||||

|

Other Counties in California |

Sep-18 |

Aug-18 |

Sep-17 |

Sep-18 |

Aug-18 |

Sep-17 |

||||

|

Amador |

NA |

NA |

4.9 |

NA |

NA |

46.0 |

||||

|

Butte |

4.4 |

3.0 |

3.4 |

15.0 |

18.0 |

15.0 |

||||

|

Calaveras |

5.9 |

5.2 |

6.2 |

50.0 |

61.0 |

41.0 |

||||

|

Del Norte |

5.2 |

6.7 |

9.2 |

89.0 |

125.0 |

71.0 |

||||

|

El Dorado |

4.6 |

4.0 |

3.9 |

32.0 |

37.5 |

41.0 |

||||

|

Humboldt |

6.6 |

5.5 |

4.7 |

29.0 |

22.0 |

34.0 |

||||

|

Lake |

8.0 |

5.5 |

5.4 |

54.0 |

40.0 |

47.0 |

||||

|

Lassen |

6.3 |

5.8 |

6.8 |

98.5 |

65.0 |

89.5 |

||||

|

Mariposa |

8.4 |

9.1 |

9.3 |

22.0 |

28.0 |

45.0 |

||||

|

Mendocino |

9.7 |

8.4 |

5.4 |

75.0 |

54.0 |

53.0 |

||||

|

Mono |

7.3 |

7.5 |

4.5 |

85.0 |

84.0 |

88.0 |

||||

|

Nevada |

6.9 |

4.5 |

4.7 |

33.0 |

24.0 |

40.0 |

||||

|

Plumas |

11.3 |

8.1 |

9.0 |

83.5 |

94.0 |

114.0 |

||||

|

Shasta |

4.5 |

4.0 |

4.2 |

33.0 |

32.0 |

27.0 |

||||

|

Siskiyou |

5.6 |

5.7 |

6.5 |

59.0 |

29.0 |

45.0 |

||||

|

Sutter |

4.2 |

3.1 |

3.1 |

23.0 |

18.0 |

19.5 |

||||

|

Tehama |

5.8 |

6.8 |

7.6 |

74.0 |

53.5 |

55.0 |

||||

|

Tuolumne |

7.7 |

5.7 |

5.0 |

45.0 |

32.0 |

42.0 |

||||

|

Yolo |

3.9 |

2.8 |

2.3 |

14.5 |

14.0 |

17.5 |

||||

|

Yuba |

3.9 |

2.6 |

3.0 |

22.5 |

18.0 |

14.0 |

||||

Source: C.A.R.