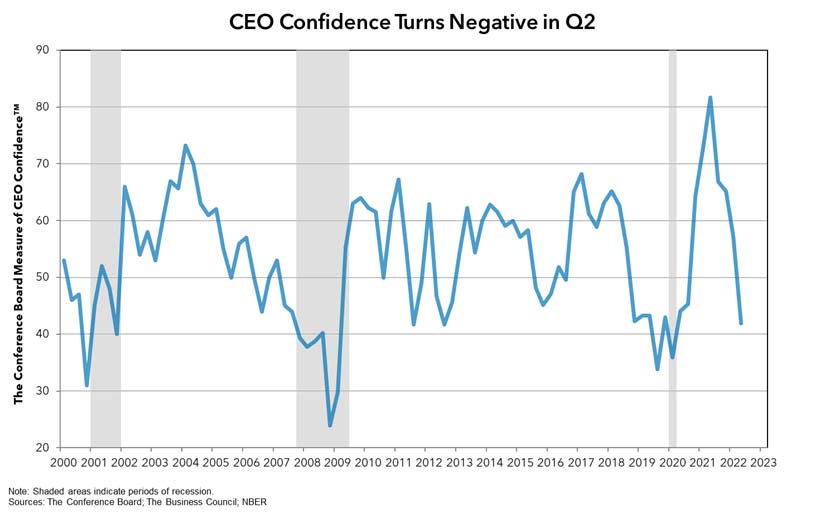

May 23, 2022 - The Conference Board Measure of CEO Confidence™ in collaboration with The Business Council declined for the fourth consecutive quarter in Q2 2022. The measure now stands at 42, down from 57 in Q1. The Measure has fallen into negative territory and is at levels not seen since the onset of the pandemic. (A reading below 50 points reflects more negative than positive responses.)

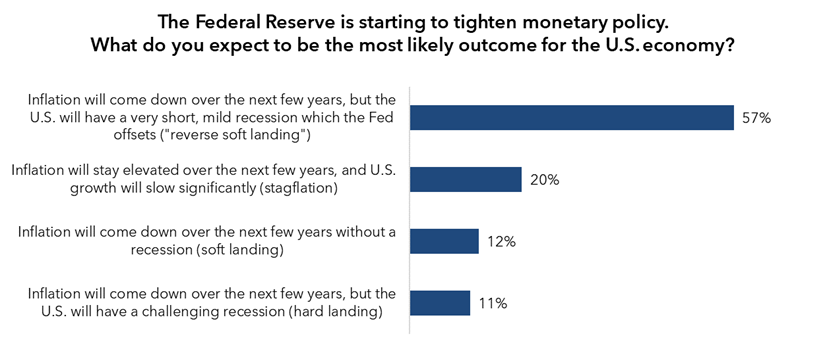

The Q2 survey also asked CEOs to share their views on the Federal Reserve’s tightening policy. Notably, nearly 60 percent of CEOs expect inflation will come down over the next few years. But they also believe that the interest rate hikes that will tame inflation will cause a recession—albeit, a very brief, mild recession that the Fed offsets.

“CEO confidence weakened further in the second quarter, as executives contended with rising prices and supply chain challenges, which the war in Ukraine and renewed COVID restrictions in China exacerbated,” said Dana M. Peterson, Chief Economist of The Conference Board. “Expectations for future conditions were also bleak, with 60 percent of executives anticipating the economy will worsen over the next six months—a marked rise from the 23 percent who held that view last quarter.”

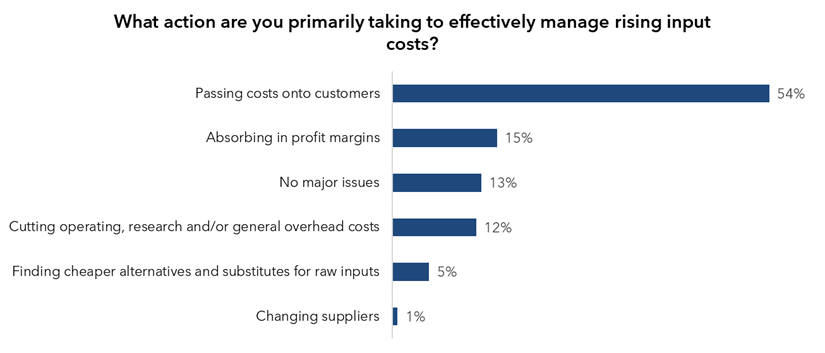

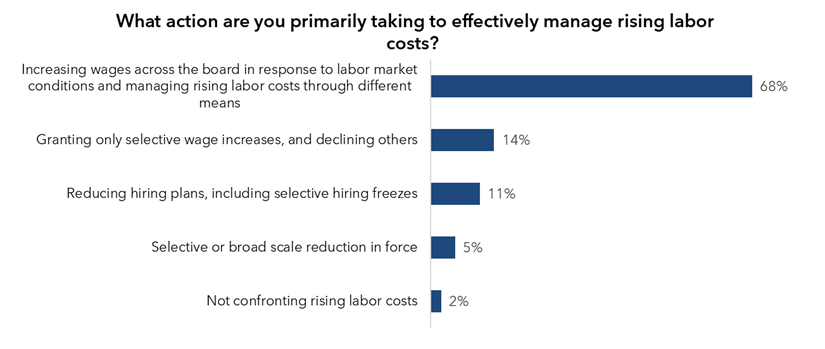

“Amid historically low unemployment and record job openings, nearly 70 percent of CEOs are combating a tight labor market by increasing wages across the board,” said Roger W. Ferguson, Jr., Vice Chairman of The Business Council and Trustee of The Conference Board. “On top of that, companies are grappling with higher input costs, which 54 percent of CEOs said they are passing along to their customers. This may contribute to cooling in consumer spending heading into the summer.”

Current Conditions

CEOs’ assessment of general economic conditions declined in Q2 2022:

- 14% of CEOs reported economic conditions were better compared to six months ago, down from 34% in Q1 2022.

- 61% said conditions were worse, up from 35%.

CEOs were more pessimistic about conditions in their own industries in Q2 2022:

- 24% of CEOs reported that conditions in their industries were better compared to six months ago, down from 40%.

- 37% said conditions in their own industries were worse, up from 22%.

Future Conditions

CEOs’ expectations about the short-term economic outlook weakened in Q2:

- 19% of CEOs said they expected economic conditions to improve over the next six months, down from 50% in Q1.

- 60% expected conditions to worsen, up from 23%.

CEOs’ expectations regarding short-term prospects in their own industries declined in Q2:

- 28% of CEOs expected conditions in their own industry to improve over the next six months, down from 58%.

- 34% expected conditions to worsen, up from 13%.

Employment, Recruiting, Wages, and Capital Spending

- Employment: 63% of CEOs expect to expand their workforce, down from 66% in Q1.

- Hiring Qualified People: 80% of CEOs report some problems attracting qualified workers, down from 83% in Q1. Notably, 61% report difficulties that cut across the organization, rather than concentrated in a few key areas—down from 66% in Q1.

- Wages: 91% of CEOs expect to increase wages by 3% or more over the next year, up from 85% in Q1.

- Capital Spending: 38% of CEOs expect to increase their capital budgets in the year ahead, down from 48% in Q1.

Inflation:

What is the most likely outcome of the Federal Reserve’s tightening policy?

- Nearly 60% of CEOs expect inflation will come down over the next few years, but the U.S. will have a very short, mild recession which the Fed offsets ("reverse soft landing"), while 11% foresee a challenging recession. Twenty percent said inflation will stay elevated over the next few years, and U.S. growth will slow significantly (stagflation).

How are CEOs Managing Input and Labor Costs?

- More than half (54%) of CEOs said they were effectively managing rising input costs by passing along costs to customers, while 13% said they had no major issues with input costs.

- More than two-thirds of CEOs said they are increasing wages across the board in response to labor market conditions and managing rising labor costs through different means.

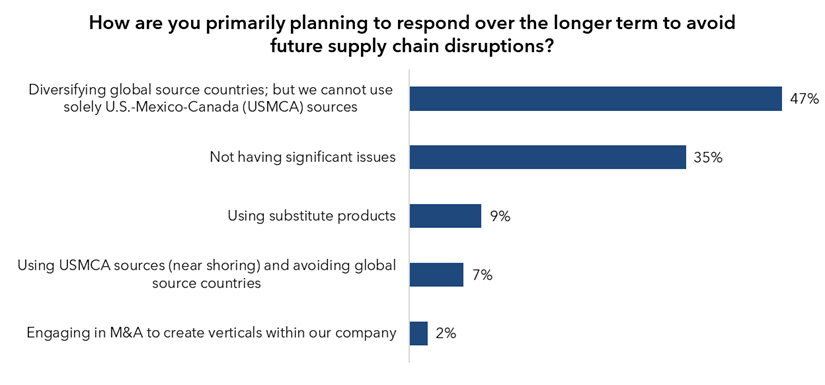

Long range plans to strengthen supply chain:

How are CEOs planning to respond over the longer term to avoid future supply chain disruptions?

- Almost half of all CEOs said they are diversifying global source countries; but cannot use solely U.S.-Mexico-Canada (USMCA) sources. An additional 35% said they are not experiencing any significant disruptions.

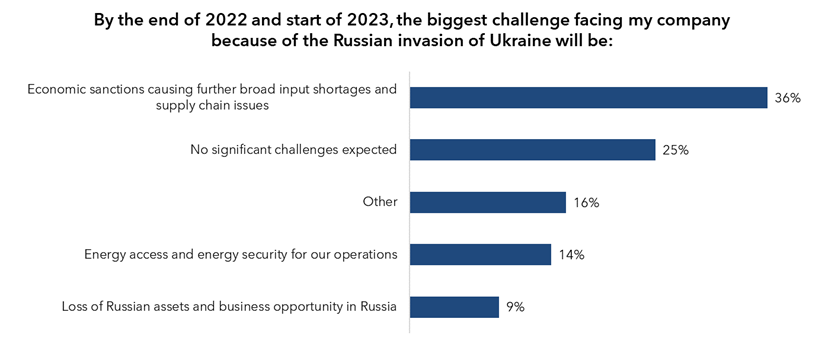

Geopolitical challenges:

What is the biggest challenge CEOs foresee by the end of 2022 and start of 2023, because of the Russian invasion of Ukraine?

- More than one-third of CEOs said the biggest challenge they face from economic sanctions against Russia are input shortages and supply chain issues.

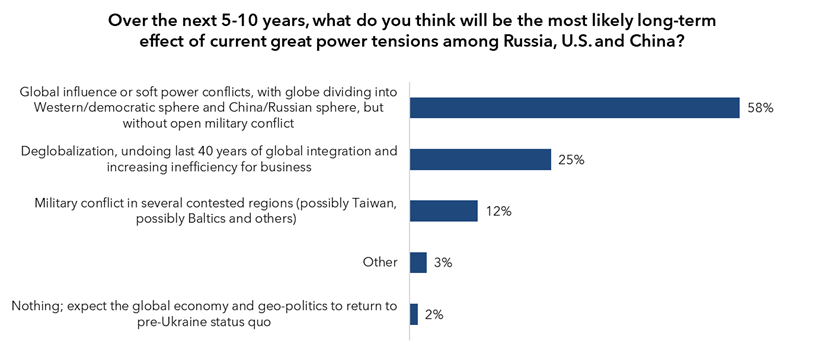

Over the next 5-10 years, what do you think will be the most likely long-term effect of current great power tensions among Russia, U.S. and China?

- Close to 60% of CEOs said geopolitical tensions will likely result in the globe dividing into Western/democratic and China/Russian spheres.

About The Conference Board

The Conference Board is the member-driven think tank that delivers trusted insights for what’s ahead. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org

About The Business Council

The Business Council is a forum for the CEOs of the world’s largest multinational corporations across all industry sectors. Members gather several times each year to share best practices, network and engage in intellectually provocative, enlightening discussions with peers and thought-leaders in business, government, academia, science, technology and other disciplines. Through the medium of discussion, the Council seeks to foster greater understanding of the major opportunities and challenges facing business, and to create consensus for solutions. The Business Council is a non-partisan, not-for-profit entity holding 501 (c) (6) tax-exempt status. The Business Council does not lobby. Visit The Business Council’s website at www.thebusinesscouncil.org